To download the Historical Tables as a PDF, click here (362 pages, 6.4 MB)

Create and Print Rent Receipts Templates Pre Filled for Free. Option to generate rent receipt printable online - Monthly, Quarterly, Half-Yearly and Yearly. For claiming HRA exemptions it is mandatory to submit Rent Receipts to the employer. This can be done in just 4 simple steps. Generate rent receipt by filling in the required details.

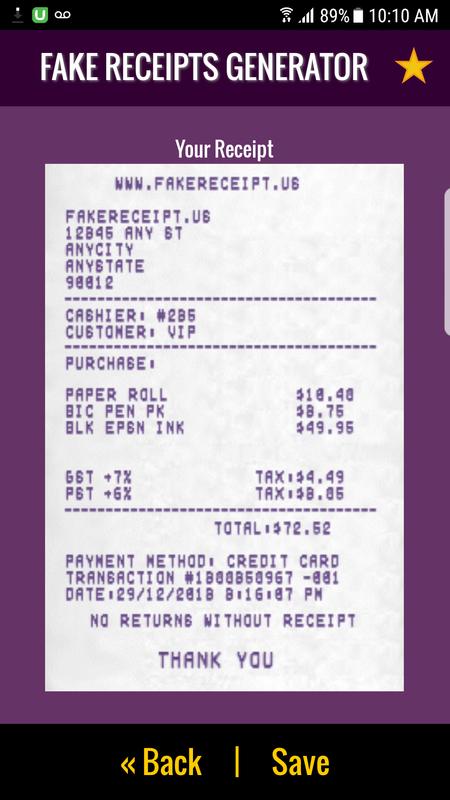

- Download this app from Microsoft Store for Windows 10, Windows 8.1. See screenshots, read the latest customer reviews, and compare ratings for My Receipts.

- Receipt software, free download - Receipt Template - Receipt Forms, Simple Receipt, Free Receipt Maker, and many more programs.

2.1.1 receipts If the employee presents an acceptable receipt for Form I-9 showing that he or she applied to replace a document that was lost, stolen or damaged, the employer must set aside this employee's Form I-9 and wait to create a case in E-Verify. Instantly Download Free Receipt Templates, Samples & Examples in Adobe PDF, Microsoft Word (DOC), Microsoft Excel (XLS), Adobe Photoshop (PSD), Google Docs, Apple (MAC) Pages, Google Sheets (Spreadsheets), Apple (MAC) Numbers, Adobe Illustrator (AI) Formats.

Receipts 1 9 2 download free. full Game Windows 7

To download the Historical Tables Introductory Text and Section notes as a PDF, click here (23 pages, 212 KB)

Spreadsheets

To download all Historical Tables in XLS format as a single ZIP file, click here (941 KB)

Table 1.1—Summary of Receipts, Outlays, and Surpluses or Deficits (-): 1789–2025

Table 1.2—Summary of Receipts, Outlays, and Surpluses or Deficits (-) as Percentages of GDP: 1930–2025

Table 1.3—Summary of Receipts, Outlays, and Surpluses or Deficits (-) in Current Dollars, Constant (FY 2012) Dollars, and as Percentages of GDP: 1940–2025

Table 1.4—Receipts, Outlays, and Surpluses or Deficits (-) by Fund Group: 1934–2025

Table 2.1—Receipts by Source: 1934–2025

Table 2.2—Percentage Composition of Receipts by Source: 1934–2025

Table 2.3—Receipts by Source as Percentages of GDP: 1934–2025

Table 2.4—Composition of Social Insurance and Retirement Receipts and of Excise Taxes: 1940–2025

Table 2.5—Composition of 'Other Receipts': 1940–2025

Table 3.1—Outlays by Superfunction and Function: 1940–2025

Table 3.2—Outlays by Function and Subfunction: 1962–2025

Table 4.1—Outlays by Agency: 1962–2025

Table 4.2—Percentage Distribution of Outlays by Agency: 1962–2025

Table 5.1—Budget Authority by Function and Subfunction: 1976–2025

Table 5.2—Budget Authority by Agency: 1976–2025

Table 5.3—Percentage Distribution of Budget Authority by Agency: 1976–2025

Table 5.4—Discretionary Budget Authority by Agency: 1976–2025

Table 5.5—Percentage Distribution of Discretionary Budget Authority by Agency: 1976–2025

Table 5.6—Budget Authority for Discretionary Programs: 1976–2025

Table 7.1—Federal Debt at the End of Year: 1940–2025

Table 7.2—Debt Subject to Statutory Limit: 1940–2025

Table 7.3—Statutory Limits on Federal Debt: 1940–Current

Receipts 1 9 2 Download Free Version

Table 8.1—Outlays by Budget Enforcement Act Category: 1962–2025

Table 8.2—Outlays by Budget Enforcement Act Category in Constant (FY 2012) Dollars: 1962–2025

Table 8.3—Percentage Distribution of Outlays by Budget Enforcement Act Category: 1962–2025

Table 8.4—Outlays by Budget Enforcement Act Category as Percentages of GDP: 1962–2025

Table 8.5—Outlays for Mandatory and Related Programs: 1962–2025

Table 8.6—Outlays for Mandatory and Related Programs in Constant (FY 2012) Dollars: 1962–2025

Table 8.7—Outlays for Discretionary Programs: 1962–2025

Table 8.8—Outlays for Discretionary Programs in Constant (FY 2012) Dollars: 1962–2025

Table 9.1—Total Investment Outlays for Physical Capital, Research and Development, and Education and Training: 1962–2021

Table 9.2—Major Public Physical Capital Investment Outlays in Current and Constant (FY 2009) Dollars: 1940–2021

Table 9.3—Major Public Physical Capital Investment Outlays in Percentage Terms: 1940–2021

Table 9.4—National Defense Outlays for Major Public Direct Physical Capital Investment: 1940–2021

Table 9.5—Nondefense Outlays for Major Public Direct Physical Capital Investment: 1940–2021

Table 9.6—Composition of Outlays for Grants for Major Public Physical Capital Investment: 1941–2021

Table 9.7—Summary of Outlays for the Conduct of Research and Development: 1949–2021 (In Current Dollars, as Percentages of Total Outlays, as Percentages of GDP, and in Constant (FY 2012) Dollars)

Table 9.8—Composition of Outlays for the Conduct of Research and Development: 1949–2021

Table 9.9—Composition of Outlays for the Conduct of Education and Training: 1962–2021

Table 11.1—Summary Comparison of Outlays for Payments for Individuals: 1940–2025 (In Current Dollars, as Percentages of Total Outlays, as Percentages of GDP, and in Constant (FY 2012) Dollars)

Table 11.2—Functional Composition of Outlays for Payments for Individuals: 1940–2025

Table 11.3—Outlays for Payments for Individuals by Category and Major Program: 1940–2025

Table 12.1—Summary Comparison of Total Outlays for Grants to State and Local Governments: 1940–2025 (in Current Dollars, as Percentages of Total Outlays, as Percentages of GDP, and in Constant (FY 2012) Dollars)

Table 12.2—Total Outlays for Grants to State and Local Governments, by Function and Fund Group: 1940–2025

Table 12.3—Total Outlays for Grants to State and Local Governments, by Function, Agency, and Program: 1940–2021

Table 14.1—Total Government Receipts in Absolute Amounts and as Percentages of GDP: 1948–2019

Table 14.2—Total Government Expenditures: 1948–2019

Table 14.3—Total Government Expenditures as Percentages of GDP: 1948–2019

Table 14.4—Total Government Expenditures by Major Category of Expenditure: 1948–2019

Table 14.5—Total Government Expenditures by Major Category of Expenditure as Percentages of GDP: 1948–2019

Table 14.6—Total Government Surpluses or Deficits (-) in Absolute Amounts and as Percentages of GDP: 1948–2019

Table 16.1—Total Executive Branch Civilian Full-Time Equivalent (FTE) Employees, 1981–2021

Table 16.2—Total Executive Branch Civilian Full-Time Equivalent (FTE) Employees, 1981–2021 (as percentage of total)

Budget

Analytical Perspectives

Appendix

Supplemental Materials

Fact Sheets